The global recession has hit hard, but Chinese demand for paints and coatings—especially protective coatings— is proving even stronger.

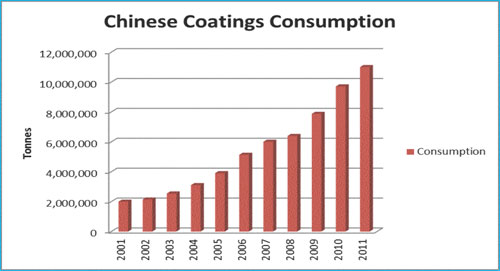

Buoyed by a bevy of factors, the world’s most populous nation has increased its paint and coatings consumption by more than fivefold in the last decade, a new market report shows.

Big Events, Big Infrastructure

Boosted by mega-events such as the Beijing Olympic Games in 2008, Shanghai World Expo in 2010 and Guangzhou Asian Games in 2010, “

“Indeed China has continued to invest in infrastructure development, including new bridges, landmark city buildings, alternative energy facilities, nuclear generation plants, schools, and hospitals.”

That activity has fueled double-digit growth in the Chinese coatings market every year since 2002, with the exception of 2008, the report said.

Protective Coatings Outlook

Over the next five years, annual market growth is expected to remain about 10%, with the fastest growth expected in protective coatings, road marking paints, coatings for plastics and automotive refinishes.

“These booming sectors will compensate for considerably slower growth in automotive OEM coatings and wood coatings,” the report said.

“This dynamic market has continued its growth trajectory despite the global economic recession by focusing on domestic market demand in the construction, automotive and home appliances/consumer electronics sectors,” IRL reported.

Big Events, Big Infrastructure

Boosted by mega-events such as the Beijing Olympic Games in 2008, Shanghai World Expo in 2010 and Guangzhou Asian Games in 2010, “

“Indeed China has continued to invest in infrastructure development, including new bridges, landmark city buildings, alternative energy facilities, nuclear generation plants, schools, and hospitals.”

That activity has fueled double-digit growth in the Chinese coatings market every year since 2002, with the exception of 2008, the report said.

Protective Coatings Outlook

Over the next five years, annual market growth is expected to remain about 10%, with the fastest growth expected in protective coatings, road marking paints, coatings for plastics and automotive refinishes.

“These booming sectors will compensate for considerably slower growth in automotive OEM coatings and wood coatings,” the report said.

Per-capita paint consumption in

The Chinese coatings industry continues to be highly fragmented, with as many as 20,000 active manufacturers, most of them operating on a very small scale.

That is likely to change, however, with future consolidation likely as environmental pressures and demands for higher-quality products increase, the report said.

Tomorrow’s Trends

Future opportunities will arise from factors such as:

• Pressure on the new Chinese Communist Party leadership, at its 18th Congress in October, to introduce measures to stimulate the economy after many government incentives were pulled in 2011;

• The government’s affordable-housing program plans to build 36 million new dwellings over the next five years;

• Rural areas offering opportunity for infrastructural development and untapped consumer demand;

• Rising car ownership, poor road conditions, and a very low scrappage rate, boosting demand for automotive refinishes;

• Growing demand by end-user industries for coatings offering more functionality, environmental benefits and safety features (for example, lead-free, VOC-free, formaldehyde-free) to meet stricter export standards and a younger, more discerning domestic market; and

• Growing sales of marine and protective coatings, bolstered by offshore engineering schemes and infrastructure development.

as many as 20,000 active manufacturers, most of them operating on a very small scale.

“This dynamic market has continued its growth trajectory despite the global economic recession by focusing on domestic market demand in the construction, automotive and home appliances/consumer electronics sectors,” IRL reported.

Big Events, Big Infrastructure

Boosted by mega-events such as the Beijing Olympic Games in 2008, Shanghai World Expo in 2010 and Guangzhou Asian Games in 2010, “

“Indeed China has continued to invest in infrastructure development, including new bridges, landmark city buildings, alternative energy facilities, nuclear generation plants, schools, and hospitals.”

That activity has fueled double-digit growth in the Chinese coatings market every year since 2002, with the exception of 2008, the report said.

Protective Coatings Outlook

Over the next five years, annual market growth is expected to remain about 10%, with the fastest growth expected in protective coatings, road marking paints, coatings for plastics and automotive refinishes.

“These booming sectors will compensate for considerably slower growth in automotive OEM coatings and wood coatings,” the report said.

Per-capita paint consumption in

The Chinese coatings industry continues to be highly fragmented, with as many as 20,000 active manufacturers, most of them operating on a very small scale.

That is likely to change, however, with future consolidation likely as environmental pressures and demands for higher-quality products increase, the report said.

Tomorrow’s Trends

Future opportunities will arise from factors such as:

• Pressure on the new Chinese Communist Party leadership, at its 18th Congress in October, to introduce measures to stimulate the economy after many government incentives were pulled in 2011;

• The government’s affordable-housing program plans to build 36 million new dwellings over the next five years;

• Rural areas offering opportunity for infrastructural development and untapped consumer demand;

• Rising car ownership, poor road conditions, and a very low scrappage rate, boosting demand for automotive refinishes;

• Growing demand by end-user industries for coatings offering more functionality, environmental benefits and safety features (for example, lead-free, VOC-free, formaldehyde-free) to meet stricter export standards and a younger, more discerning domestic market; and

• Growing sales of marine and protective coatings, bolstered by offshore engineering schemes and infrastructure development.