Growth in India's economy is driving expansion for petrochemical and polymer production. The country has new capacities coming on line in the next few years as expansion projects get underway.

Demand for polyvinyl chloride(PVC) in India rose by 3% to 1.98m tonnes over the 2011-2012 fiscal year, prompted by the country's tight fiscal policy. This is a higher growth rate than earlier expectations of 1-2% per year, according to S.S. Naik, senior vice president at India-based Reliance Industries, speaking at the Vinyl India 2012 conference in Mumbai in April.

Imports of PVC into India are expected to increase significantly as demand outstrips the country's downstream processing capacity. The country imported 729,000 tonnes of PVC in the year to March 31, 2012, reflecting an increase of 55,000 tonnes from the previous year. India-based producers are facing severe competition from overseas suppliers, Naik said.

Pipes remain the dominant end-use for PVC, accounting for 70% of demand. Investment in India's construction and irrigation sectors is expected to grow, providing a potential growth avenue for PVC.

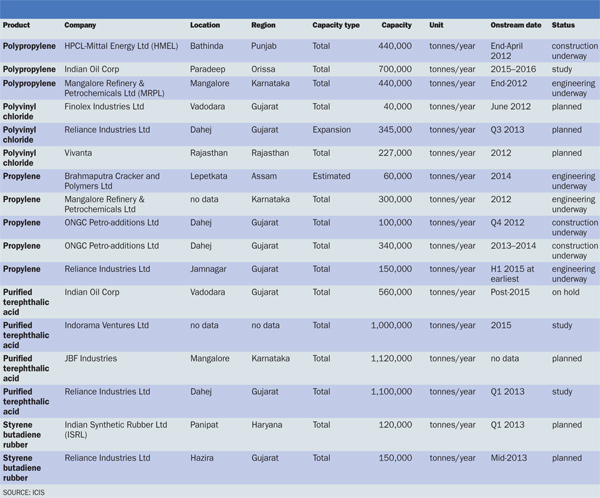

New PVC capacity being built in India includes a 40,000 tonne/year plant in Vadodara, Gujarat, by Finolex Industries, expected to be onstream in June 2012; a 345,000 tonne/year expansion at Reliance's site in Dahej, Gujarat, expected onstream in the third quarter of 2013; and a 227,000 tonne/year facility in Rajasthan by Vivanta, slated to come on stream this year.

Meanwhile, India's petrochemical industry is expected to register robust growth in the years ahead as a result of continuing efforts to enhance its competitive advantage. Despite the 2008 financial crisis, India's petrochemical sector has a favorable outlook, with analysts expecting a 15% compounded annual growth rate (CAGR), said Kamal Nanavaty, vice president of the Chemicals and Petrochemicals Manufacturers Association (CPMA) of India. Nanavaty spoke at the 34th annual Asia Petrochemical Industry Conference (APIC), which took place in Kuala Lumpur, Malaysia, in May.

View full size graph

In comparison, demand in India's polymers sector is expected to grow at 8-12% in 2012-2013. The sector's demand growth in 2011 was at 4.6%, according to CPMA.

Another big polymers project underway is Reliance's 1.1m tonne/year purified terephthalic acid(PTA) project at Dahej, Gujarat. The company has said it is on track to start up in 2013-2014.

Construction of the plants began late last year, with the first plant expected to come on line in the fourth quarter of 2013. The second plant is expected to start up six months later, in 2014. The two units will be the world's largest plants, with single unit capacity exceeding 1m tonnes/year. The plants will use Invista's PTA technology.

Reliance entered an agreement in February 2012 to form a joint venture with SIBUR, a major petrochemical company in Russia and Eastern Europe. The joint venture, Reliance Sibur Elastomers, will produce 100,000 tonnes/year of butyl rubber in Jamnagar, India. Start up is expected for mid-2014. The joint venture will run India's first butyl rubber manufacturing facility, according to Reliance. The plant will use Sibur's proprietary butyl rubber technology.